MARKET-OPPORTUNITY

LARGE & CONSERVATIVE

REAL ESTATE MARKET

TECHNOLOGICAL &

INNOVATIVE BREAKTHROUGHS

ENVIRONMENTAL

DEMOGRAPHIC AND SOCIETAL

SHIFTS CONVERGING

PropTech is the sustainability and innovation-focused transformation of the ‘built world’ value chain, changing the way we research, design, finance, buy, market, build, rent, sell, manage, operate and experience property. The complete real estate value chain is being disrupted by emerging technology breakthroughs like artificial intelligence, 5G, machine learning, big data analytics, internet of things and circular building materials, combined with the extremely high user connectivity thanks to omnipresent mobile devices. This is now accelerated even further by several external factors like stringent climate laws, demographic shifts, changing customer expectations and the general digitization trend spurred by the Covid-19 pandemic

FINANCE& INVEST

Data insights(market)

DESIGN & BUILD

- Environment

- Safety

- Productivity

MARKET & TRANSACT

- Customer experience

- Cut the middleman

MANAGE & OPERATE

- Data insights (buildings)

- Energy consumption

- Operational efficiencies

LIVE & WORK

Flexibility

The modern property mantra is therefore no longer ‘location, location, location’, but ‘location, experience, analytics’. This disruptive transformation is going to have a massive impact on the entire real estate industry, similar to the impact FinTech has had on the traditional finance industry. With over 3,000 active companies, the European PropTech industry represents 40% of the global market. However, receiving only 11% of global PropTech funding, there is a large funding gap for growth acceleration and an opportunity for consolidation in the European PropTech market

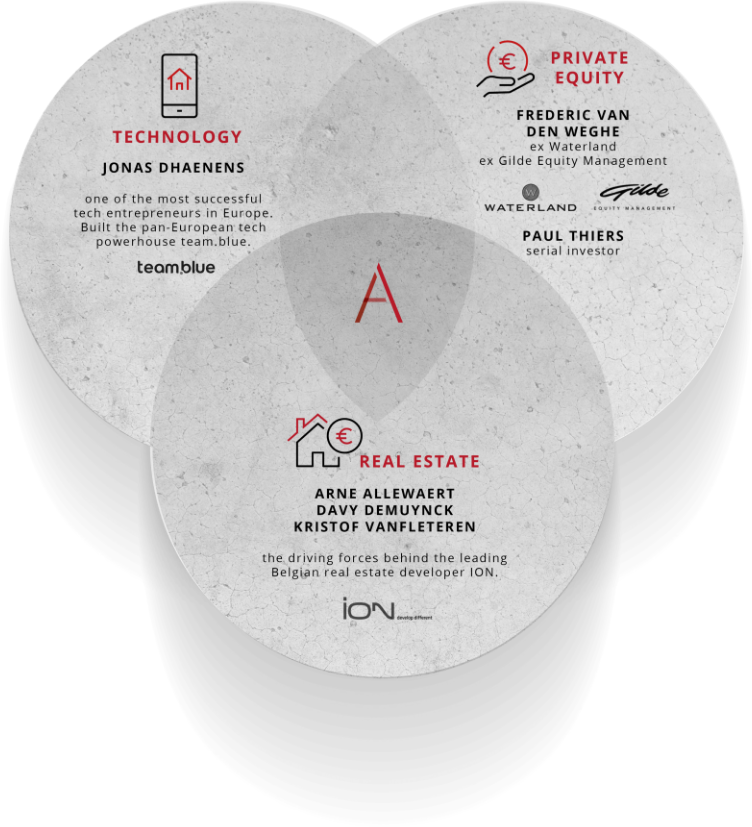

FOUNDING TEAM

IN – DEPTH KNOWLEDGE OF

REAL ESTATE INDUSTRY

PAN – EUROPEAN

NETWORK

COMPLEMENTARY

EXPERTISE

INVESTMENT-OPPORTUNITY

DEDICATED AND FULLY

INDEPENDENT PAN – EUROPEAN

PROPTECH FUND

€60M TARGET FUND SIZE /

FIRST CLOSING OF

€40M ACHIEVED

EXISTING PORTFOLIO OF

6 INVESTMENTS TO DATE

AMAVI PROPTECH FUND CommV provides growth capital to private companies active in the European PropTech industry. Over the fund term of 10 years, investments in 10-15 companies are anticipated. AMAVI is not targeting start-ups, but scale-ups with a proven track record and product/market fit that require growth capital. AMAVI will invest between 0.5 million and 9 million EUR per portfolio company, potentially spread over several financing rounds.

By including real estate linked investors in its LP base, AMAVI creates a bridge and ecosystem between the traditional real estate actors and the groundbreaking PropTech companies. Investors can experience new business models and technologies from the first row and can leverage on co-investment opportunities in portfolio companies that have the most impact on their business. In return, they can offer a sandbox, distribution channels and their deep industry knowledge for efficient deal flow sourcing, accurate due diligence processes and value creation within the portfolio.

Thanks to AMAVI’s positioning as a strategic investor with a strong sector focus, strategic partnerships and a co-investor networkamongst generalist VCs have been built, enabling expansion across or outside Europe, sharing of deal flow, participating in larger rounds or sharing complementary expertise and knowledge.

PORTFOLIO

6 INVESTMENTS IN

5 DIFFERENT COUNTRIES

8M EUR DEPLOYED

80% COMBINED

ANNUALIZED GROWTH

Shayp is a Belgian ‘hardware enabled SaaS’ company active in water monitoring and automated leak detection for large property portfolios. They offer a fully integrated service that helps building managers, property owners, water utility companies (B2B2C) and insurers (B2B2C) to eliminate leaks and related damages, while helping to achieve ESG goals.

Co-investors: SIGNA Innovations (AU) , imec (BE)

Finch Buildings , a Dutch company active in modular off-site construction . They developed a building system to engineer and produce Cross Laminated Timber (‘CLT’) units for larger residential and commercial buildings, up to 16 floors high. The building concept delivers huge advantages in terms of timing, quality, total cost, carbon foot print and indoor air climate, while providing an answer to the ever-growing lack of skilled labour forces in construction.

Co-investors: DOEN participaties (NL), Rockstart (NL)

Finnish company Gbuilder developed a software platform that offers a holistic BIM-based solution to streamline the interaction between home buyers, project teams and the construction site, throughout the whole process from sales, configuration, execution up to after-sales.

Co-investors: Sustainable Future Ventures (Patrizia – UK), Butterfly Ventures (FI), Vendep Capital (FI)

The French company YouStock is a B2B and B2(B2)C on-demand storage platform, offering a full-service digital model starting from inventorisation, packing and pickup to storage and return of goods, by linking users, moving companies and storage facilities. Customers only pay for the m3 stored they need and can order goods back whenever they want. They created a disruptive model for the traditional self-storage market through its platform that offers more services at a lower price.

Co-investors: Turenne Capital (FR), First Risk Capital (NO)

Portugal based Casafari is the leading real estate data platform in Europe. The company has developed a proprietary machine learning technology and extensive data operations to automatically index, clean, classify and match duplicates of millions of property listings from thousands of websites in different languages. The company covers all real estate asset classes and currently serves over 15.000 professional users in countries like Spain, Italy, France and Portugal.

Co-investors: Starwood Capital (US), Prudence (US), Lakestar (UK), Round Hill Ventures (UK), FJ Labs (US) and Armilar VP (PT)

Cintoo is a French company, founded in 2013 as a spin-off from research center Sofia-Antipolis. Its core technology turns 3D point clouds from reality capturing devices into digital twins, by compressing the high-resolution data into meshes which make it much easier to upload/download the data to/from Cintoo’s secure cloud and collaborate on the data between several stakeholders and other BIM platforms like Autodesk and Bentley. The software is used during construction by a.o. general contractors, but also to monitor, manage and maintain existing assets in Industry 4.0 environments. Customers include multinationals like BP, Ford, Tesla, Engie and Bouygues.

Co-investors: Armilar Venture Partners (PT), Accenture Ventures (US), UI Investissement (FR)

MORE INFO

ARNE ALLEWAERT / +32471555578 / ARNE@AMAVI.CAPITAL

FREDERIC VAN DEN WEGHE / +32497377373 / FREDERIC@AMAVI.CAPITAL