Declutter your home, make room for what matters

KEY POINTS

📦 The adoption of self-storage accelerated by the COVID-19 pandemic, increasing housing prices, decreasing living space and other trends in recent years

📦 The traditional self-storage model has shortcomings and is being challenged by a number of new business models

📦 To meet the high customer demands, self storage business models should be more focused on efficiency and customer centricity.

1. Self storage is booming due to pandemic boost and secular tailwinds

- Mainly COVID-19 but also a combination of other factors have created an increasing need for storage space which has led to a higher demand for self-storage.

- Self-storage is a service that lets people and businesses rent storage space for their things. It’s often provided in large facilities, subdivided into units that customers can rent and access anytime. Self storage facilities usually offer different unit sizes and are in the close vicinity of homes or businesses. The length of the rental agreement can vary depending on the customer’s needs. It’s a convenient and flexible, but rather expensive way to store belongings.

- Several factors have supported demand for self storage from residential customers in recent years. These include demographic and macroeconomic trends, such as population growth, urbanisation, higher levels of mobility, micro-living, increasing personal wealth, increased number of divorces, as well as increased consumer awareness. These trends have been particularly strong in urban areas, where high density levels, elevated housing costs and the scarcity of housing and storage space are expected to support longer-term pricing rates and occupancy levels. Demand from business customers has generally been supported by the growth of new online retailers and small businesses, which require flexible and cost- effective storage options. We expect these trends to continue to support the demand for self storage in the coming years. Source

Let’s dive into the main drivers of the increased demand for self storage next.

1.1 COVID redefined spare rooms to work-from-home offices

The COVID-19 pandemic has forced many people to set up temporary home offices in previously unused spaces, such as spare rooms and basements. This has allowed them to continue working remotely during lockdowns and stay-at-home orders. The pandemic has highlighted the importance of having a dedicated workspace and the adaptability of the workforce.

Unemployment levels across the world have been rising during the COVID-19 crisis. As a result, residential landlords face impact from jobless tenants who are unable to pay rent. As these tenants move back home with their families or explore other house-sharing options, downsizing residential space creates opportunities for the self-storage sector to store items that will no longer fit into smaller homes. Source

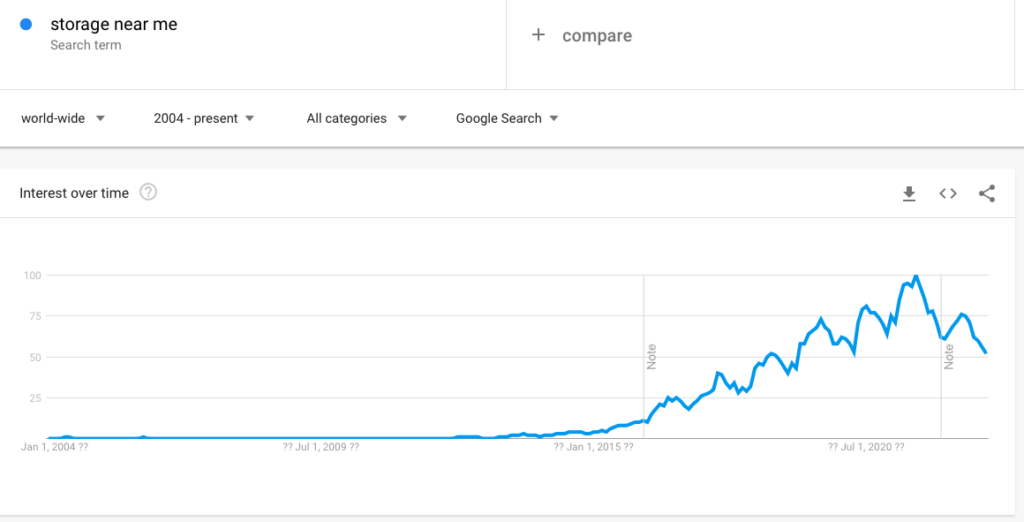

A simple query in Google Trends confirms that the request for storage was at its peak during COVID.

Note that the demand for storage really took off as from 2016.

1.2 Increasing rate of urbanisation brings more people to the city

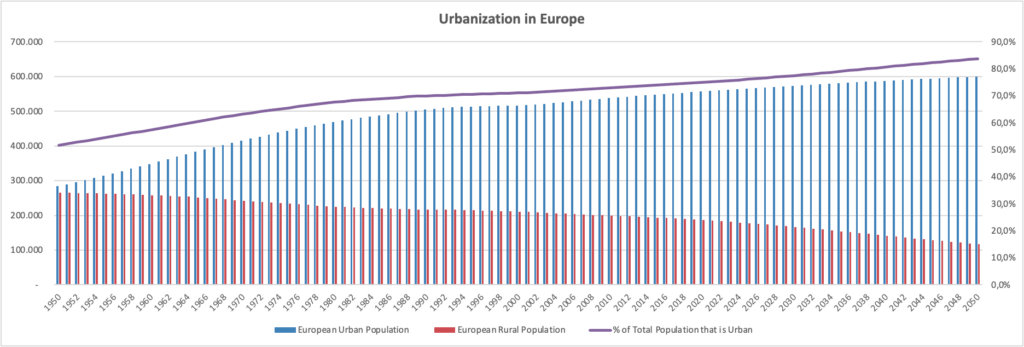

- According to the UN, 68% of the world population projected to live in urban areas by 2050.

- Moreover, Europe’s level of urbanisation is expected to increase to approximately 83.7% in 2050. → more key takeaways here.

1.3 A ‘renovation wave’ is coming up

- The European Commission has published the Renovation Wave Strategy as part of its efforts to achieve the objectives of the EU Green Deal. This strategy aims to improve the energy performance of buildings in the EU, with the aim of at least doubling renovation rates over the next ten years.

- About 50% of the residential housing market in Europe has an EPC D or worse, whereas within 10 years from now, every home will need to have at least an EPC C. This is the equivalent of about 100M homes that need to be renovated in the next decade.

- Renovations leads to a need for storing stuff temporarily.

1.4 Garage boxes gone, fewer cellar space

It has become common for newly built apartments not to include a garage box or a cellar as part of the sale. This is because construction prices have risen, leading to higher costs for developers. Focusing on profitability, many developers have decided to exclude these features from their projects, especially in dense urban areas. Additionally, increasing interest rates have decreased the purchasing power for buying a house or apartment. As a result, many new apartment buildings – particularly in urban areas – don’t have dedicated parking or storage space. This lack of space means that many apartment dwellers will need to find self-storage solutions to keep and access their belongings.

1.5 Change in consumer behaviour, new hobbies and digital nomads

Finally, there are some additional reasons why people need more storage space

- Increase in belongings: With the rise of consumer culture, people are constantly buying new items such as clothes, electronics, and home decor. These items can quickly add up, leaving people with cluttered homes and insufficient space to store everything.

- Another reason is the rise of new hobbies: as people’s interests and passions evolve, they may take up activities that require specialised or seasonal equipment (skiing, (kite)surfing, biking, etc).

- Increasing divorce rates and the number of newly-composed families, also clearly lead to a need to store more stuff.

- Lastly, the growth of the digital nomad lifestyle is also contributing to the need for more storage space: digital nomads are people who work remotely and often travel frequently, which means they may not have a fixed home base. As a result, they may need to store their belongings in a self-storage facility or other type of storage space while they are on the road.

2. Rising interest rates pressure housing prices, new business models arise

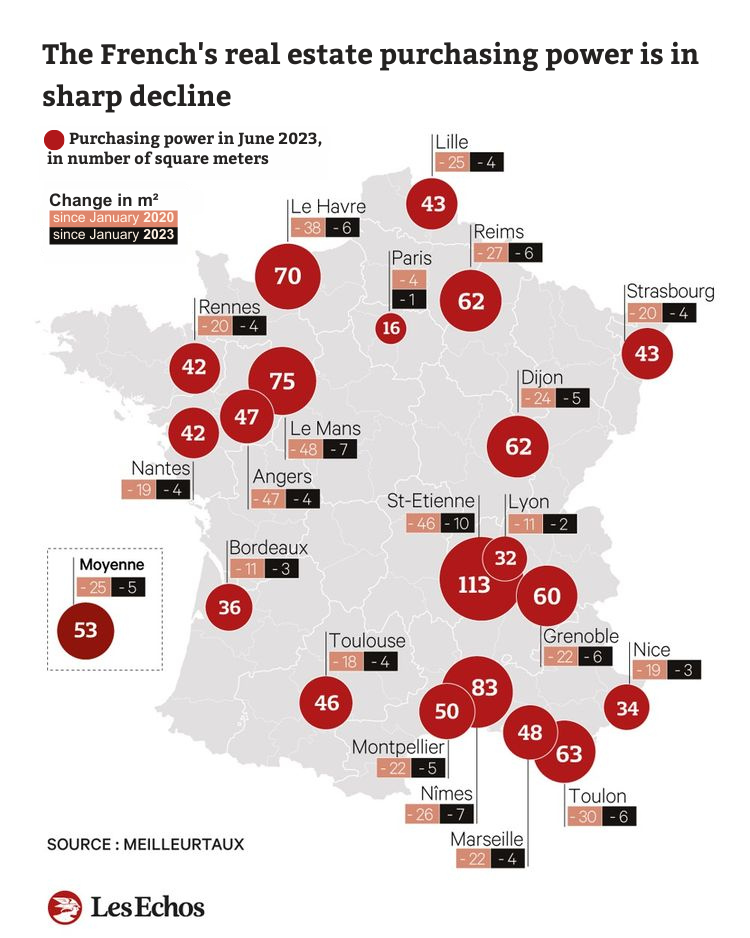

- Rising interest rates are putting pressure on the affordability of building or buying a house. This means that the floor space one can afford is decreasing significantly.

- According to an article from the World Economic Forum, almost half of the EU population lives in apartments.

- Average yearly rent per square meter in Europe is now €290, up 7.9% from last year. Source. This inherently leads to that the fact that, on average, living spaces decrease.

- In some European countries, we observe that residential floor space decreases over time – an evolution that is only expected to accelerate with current economic environment. Next to the increasing interest rates that puts pressure on buying a house, a smaller home might be more desirable for some households given that it means a decrease in monthly costs. Below, some examples of countries where this trend is taking place:

- In Belgium, flat sizes shrank from 123 m² in 1990 to 65 m² 30 years later.

- In the UK, an average British house is now more than 20% smaller than in the 1970s.

- In France, the Institute of Advanced Studies for Action in Housing (IdHeal) identified that floor space in homes have shrunk 15% over the past 20 years and that storage spaces are disappearing.

According to FEDESSA and CBRE’s latest annual report on self-storage, there has been a 5.1% growth in the number of storage facilities in Europe and a 4.8% growth in storage space in last 12 months. All of the above explains why the self-storage sector has boomed.

3. Self storage models compared

3.1 Traditional self storage

The traditional self storage business model has its draw backs resulting in a poor customer journey:

- Time consuming back-and-forth traveling to store or pick-up items

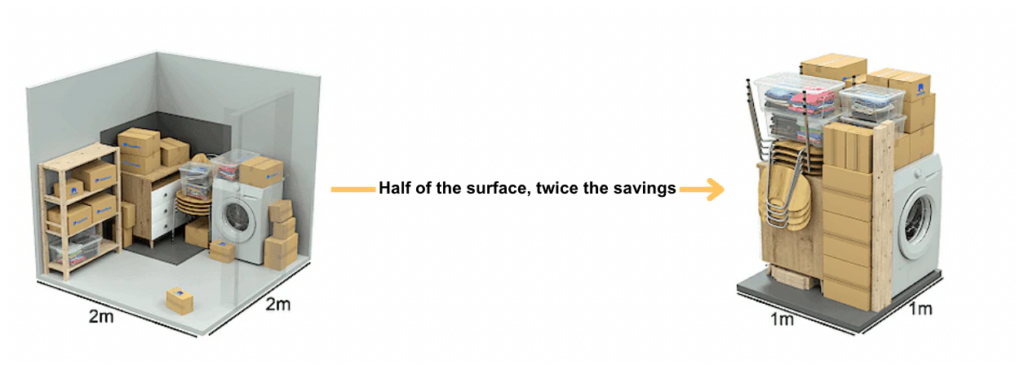

- Storage space is not made to suit your stuff resulting in paying more than what is actually used

- Expensive: you pay for m3, but can only store m2, as you cannot pile very high (so inefficient)

- Often need to rent a truck or trailer to move heavy or larger belongings

- Often not digital and general lack of customer experience

- No overview about what is actually stored at which location

💡 What could be stored?

Basically anything can be stored that finds itself at home, but some things are more desirable to get out of your way soon. Here are some examples of things that you should consider to store in a digital cellar:

1. Bulky Objects

2. Seasonal Equipment

3. Automotive tires and equipment

4. Papers and archives

5. Professional goods and equipment (such as marketing materials, showroom/seasonal furniture,…)

3.2 New business models disrupting the sector

The most disruptive factor is the fact that technology is involved to a high degree. Technology enables this sector to ‘Uberize’ the related services, use platforms to create more efficiency and make it less expensive to store externally.

Below are several new technologies related to the self-storage ecosystem. Some of these are complimentary and can be integrated in one other:

- Peer-to-peer (P2P) storage is a business model in which individuals rent out their unused storage space to others. This can include a spare room, garage, or storage unit, and is facilitated by online platforms or apps. An example to this type of storage is offered by BoxBox.

- Storage-as-a-service companies make it possible to store belongings without moving back and forth to the storage facility. They usually pick-up the user’s items at their home and deliver the desired items on-demand. Storage capacity is optimized, so you only pay for the actual m3 used. Through a periodic subscription fee, consumers only pay for what they store. Like P2P storage models, these companies usually provide a digital customer journey and handle the logistics as well. Examples are YouStock, Stored and Vinden.

- Franchised storage solutions make it possible for individuals or businesses to transform unused space into storage facilities. Several financing or leasing plans are provided for the customer in order for them to install fully equipped storage units. Example is Flexistore.

- Inner-city storage units are storage spaces that are 24/7 available, surveilled and autonomously accessible. These micro-hubs are an ideal solution for last-mile storage solutions. Examples are Storebox and Cobalt.

- Drive-up storage models are technology driven storage solutions where storage hubs (often containers) are placed locally. The user has temporary access to (a part of) that unit where items can be stored. Once the hub is filled, the belongings will be picked up and stored remotely. This addresses the challenge of door-to-door solutions, such as storage-as-a-service, which can involve a lot of travel for small loads. Example is Lovespace.

In order to scale new self-storage solutions, having the right technology is crucial. Building a warehouse with numerous storage units that require a lot of manual labor is no longer sufficient.

As part of our mission, we will always look to support solutions that radically improve the way we live, work and relax. That’s why we at AMAVI invested in the French company YouStock and the Swedish company Vinden: enabling users to free-up space in their homes and companies by using an easy application with a visual library of the items stored in your “digital cellar”. Feel free to reach out to us if you want more information on the topic or discover more about AMAVI here.

YouStock‘s “valet” storage platform, offers a full-service digital model starting from the inventory, packing, and collection to the storage facility and return of the items. They connect users, moving companies, and storage facilities. They are active in France and Belgium, and optimize inner-city logistics by partnering with a network of moving companies and warehousing facilities.

Vinden is a digital platform offering new way of storing objects. They provide on-demand storage, by picking up, storing and returning objects of all sizes. They are currently active in Sweden and Norway. Vinden combines professional warehouse keeping with last mile delivery. Everything is operated with an in-house developed, customer centric, and user-friendly platform and app.

Benelux Office (HQ) 🇧🇪

Sluis 2D2 box 3

B-9810 Eke (Belgium)

🇸🇪 Nordics office

Storgatan 23C

114 55 Stockholm (Sweden)

Are you building a PropTech scale-up in Europe with proven product-market fit?