Keep your cash – rent without a deposit

KEY POINTS

🔐 Rent guarantee insurance protects landslords against loss of income if a tenant falls behind or defaults on rent payments.

🤝 Rental insurance is a new alternative to classic rental deposits which help avoid a lock-up of a tenant’s working capital.

🙋♀️ Insurers will look to the financial stability and creditworthiness of the tenant(s) before underwriting the policy.

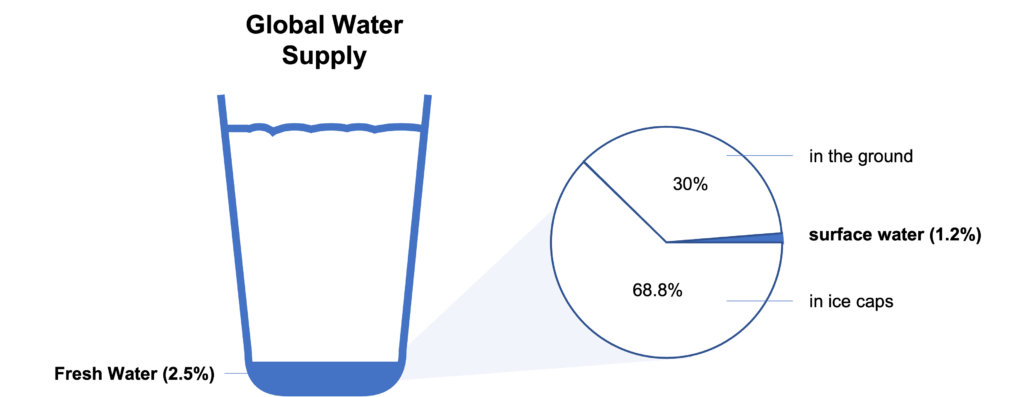

Enormous amounts are tied up to secure the rental income streams

Historically, deposit and bank guarantee have been the two dominant alternatives for landlords to ensure potential losses due to a tenant’s default or damages the rented premises. Here are a few startling data points:

- In 2019, an insurance service provider stated that $45 billion was tied up in upfront security, solely in the residential segment in the US.

- For the European residential segment, deposit volumes were estimated to reach +€70 billion in 2023.

- Over €1 billion is estimated to be tied up in commercial real estate in the Nordics, according to market research conducted by Ebie.

Needless to say, these significant amounts of capital could be put to better use in today’s challenging times.

The deposit is a type of plegde paid when signing a rental contract and is usually required when renting a home and any type of commercial space. If a tenants breaches its obligations under the lease, the landlord can use all or part of the deposit to cover its costs. This protects the landlord in case a tenant becomes insolvent and cannot pay the rent. The size of the deposit can vary greatly from lease to lease and from landlord to landlord. Usually the deposit is equivalent to three to six months’ rent, but is it not uncommon (especially not in commercial real estate) for the amount to be as high as nine or twelve months.

A bank guarantee means that the tenants’ bank guarantees the rental commitment. The bank guarantee usually has a counter guarantee amount, i.e. the amount the tenant has to provide as security to the bank in order for them to issue the guarantee. The counterpart amount usually corresponds to the bank guarantee amount, meaning that the tenant is locking up the same amount of money as with a deposit, but also pays interest for the service. The 2017 Basel 3 framework increased capital requirements for bank guarantees, meaning that very few tenants can get a bank guarantee without depositing almost the entire amount with the bank in the form of escrow. Applying and receiving a bank guarantee is a demanding process and a processing time of 6-8 weeks is not uncommon.

While some landlords may rely solely on robust tenant screening processes, unforeseen circumstances can disrupt rental income streams. Deposit or bank guarantee as rental security provides great value for the landlord, but locking up working capital is not an ideal scenario neither for individuals or businesses. Enter, the rent guarantee insurance.

What is rent guarantee insurance?

🦺 Rent guarantee insurance serves as a safeguard for landlords against financial losses incurred due to tenants failing to meet their rental obligations. In such cases, the insurance covers the monthly rent for a predetermined period, compensating landlords for the lost income.

This type of risk management tool started off for residential lease agreements in the UK and is becoming more and more popular throughout the world, as it serves as a smarter substitute to the traditional alternatives deposits and bank guarantees.

How does it work?

- The rent guarantee insurance: A convenient way to guarantee the security of the landlord without having to lock up valuable capital in a deposit. The guarantee gives the landlord the same protection as a deposit or bank guarantee, but lets the tenant keep the money. Instead, tenants (or landlord) pay an insurance premium based on the tenant’s individual risk profile.

- Apply: Most providers of this service offer online application, where the the basic information about the rental relationship is required. An application can be made wherever the tenant is in the process; just thinking about moving or is already in the new space and wants to replace its deposit.

- Wait for processing: The provider calculates the risk profile, collects approval from the landlord and prepare the contract.

- Signing the insurance: If the risk profile is approved by the insurer and the landlord accepts, a quote will be sent for approval.

- All done: Now, the tenant can choose how to invest the capital otherwise locked in a deposit.

⏩ Depending on the service provider’s level of automation, this process usually takes 1-5 business days.

No wonder why this solution is gaining traction

- The two traditional alternatives deposit and bank guarantee are win-loose alternatives: the landlord is protected, but to the cost of the tenant’s liquidity

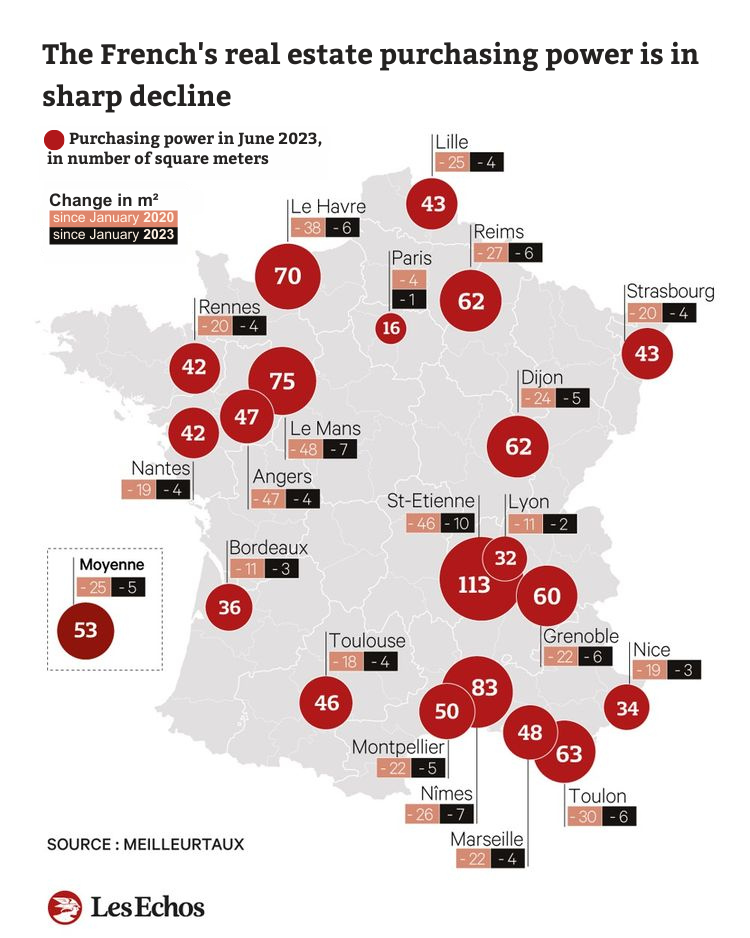

- Higher interest rates and inflation is making cash more valuable than ever

- The Central Business Districts of many major property markets are faced with record high vacancy rates, making services like the rent insurance a selling point when commercial real estate owners negotiate to maintain or attract new tenants

Some of the rent insurance providers have invested a lot of money to create fully digital, seamless handling processes to help asset owners or operators get full control of its risk management – not only as a single-use solution but part of their overall asset management.

Limitations and considerations

Insurers conduct thorough evaluations before issuing the insurance and tenants with a history of payment defaults may face rejection. Additionally, residential tenants are ofter required to have a stable employment and sufficient income, as a commercial tenant need to have a stable financial track-record to meet rent obligations.

As part of our mission, we will always look to support solutions that radically improve the way we live, work and relax. That’s why we at AMAVI invested in the Swedish company Ebie: protecting commercial real estate companies through insurance, for a fraction of the cost for the tenants. Ebie’s vision is to remove deposits from the market through a digitalized handling process and with valuable features for landlords to manage risk portfolios.

Feel free to reach out to us if you want more information on the topic or discover more about AMAVI here.

Rent guarantee insurance in commercial real estate

Ebie launched its first solution in 2022 and has already freed +€10M from deposits in the Nordics.

The market tailwinds for commercial real estate is very similar to the private market: the interest hike creates a higher need for cash and as the real estate market is forced to become more modern, landlords need to adapt to tenant wishes. Also, banks and credit institutes values secured cash-flows, motivating asset owners to get in control of its risk management.

🧩 Two innovative rent guarantee solutions for CRE

One-off (direct-to-tenant) and Group insurance (direct-to-landlord)

🤝 The one-off insurance is an insurance between a tenant and a landlord and works precisely as described above:

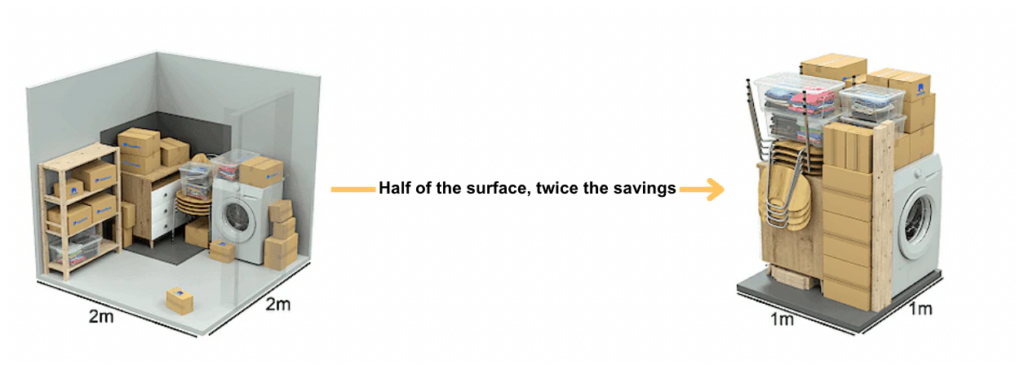

1. A tenant is looking to lease an office, a warehouse or retail space and want to avoid locking up working capital

2. The landlord wants protection and are happy with the rent insurance policy

3. The tenant has a solid track record and the insurer sets the premium at 3%

✅ Instead of locking up 9-12 months of rent in a deposit, the tenant will pay 3% of that amount as an annual insurance premium

🏢 The Group Insurance

For landlords seeing great potential to further develop its risk management and increase its NOI, Ebie has developed a Group Insurance solution:

1. By pooling a portfolio of different risks, landlord’s get a fixed premium in a framework and can add new leases whenever they occur or are up for renewal

2. With a fixed premium and a way for tenant’s to avoid paying a deposit, the landlord can charge a fee for the service – creating an arbitrage opportunity and extra revenue stream potential

3. All Group contracts are easily added and managed through Ebie’s used-friendly platform, where additional portfolio risk analysis can be conducted

✅ The landlords get full control of its risk management and enables additional revenues

Benelux Office (HQ) 🇧🇪

Sluis 2D2 box 3

B-9810 Eke (Belgium)

🇸🇪 Nordics office

Storgatan 23C

114 55 Stockholm (Sweden)

Are you building a PropTech scale-up in Europe with proven product-market fit?